Covr Financial Technologies: Creating a more positive experience when discussing life insurance with financial advising clients.

Financial planning clients often don’t like to talk about death, disabilities or long-term care, but they should absolutely want to talk about it. There’s no financial plan that’s complete without adding protection, and the mindset clients are in during financial planning conversations is the perfect time to address these needs – while they’re thinking about their goals and finances.

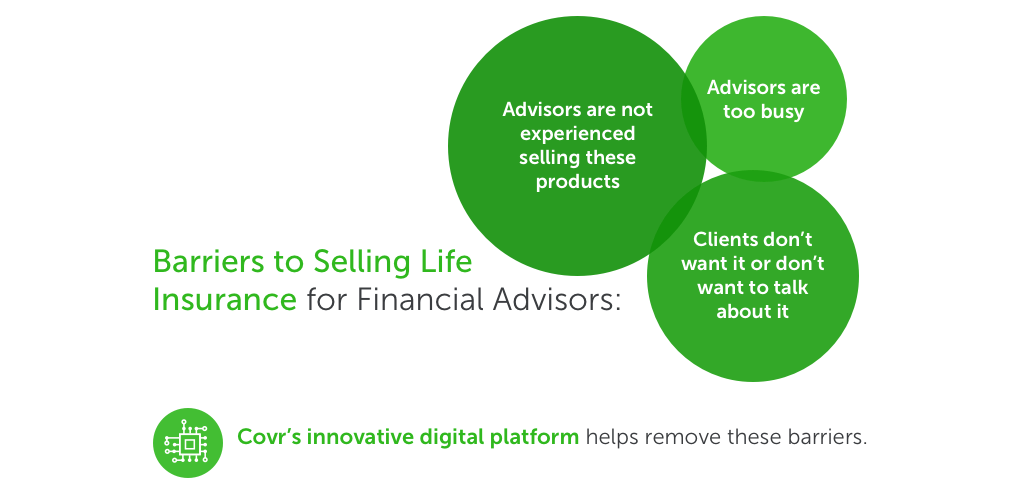

Some advisors aren’t comfortable asking clients the medical questions that are often necessary in life insurance discussions, and Covr can ease that barrier as well. Covr’s highly trained staff asks those questions while keeping advisors informed, but out of those sensitive discussions.

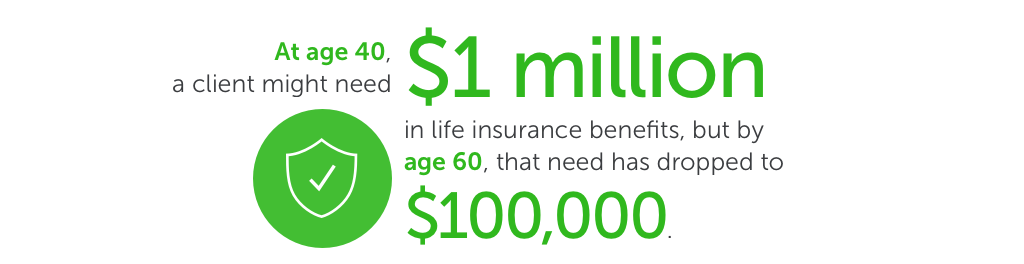

Planning meetings are also the simplest time to complete insurance applications. The information needed to create a financial plan includes much of the same information needed to apply for life insurance or other types of protection. It could also end up making the process more cost effective, as advisors and clients can dig in and get very specific about life insurance needs. Those needs change over lifetimes as mortgages are paid off and children go to college, and eliminating excess coverage is financially advantageous for both advisor and client. Talking about life insurance during planning meetings makes it simple to adjust for life changes.

Keep in mind also that if advisors don’t include protection in a financial plan, clients will go to someone else for that need. And that other person will likely try to acquire their assets under management.

Addressing these needs can also help grow an advisor’s assets under management, as it puts the advisor in the communication loop when it comes to the death benefit. In addition, many clients are more comfortable receiving a check from a trusted advisor after a loss than from a stranger, or finding it sitting in a mailbox.

Additionally, clients often think they can’t afford these types of policies – why drain retirement savings toward protection products? But that’s a small-minded view. These products can actually increase assets and retirement flexibility, and Covr’s digital platform allows advisors to show clients real-time quotes during the life insurance part of a financial planning meeting.

It’s important to talk to clients about directing discretionary money into protecting themselves – the financial plan becomes self-completing, and creates additional value for advisors along with flexibility and peace of mind for clients.